Home » News »

Common restrictions on Australia imports into China, Japan and the USA

« Previous | Next »

International trade, particularly Australia imports, is very important to the country’s economy. This not only allows Australians to pay less for products exported into the country, it also allows businesses importing to other countries to profit from an expanded market.

There are, however, certain limitations to Australian imports entering the premises of other countries, particularly China, Japan and the USA. What are these restrictions? Until when will these restrictions be imposed?

Common restrictions on Australia imports into China, Japan and the USA

Tariffs on Australia imports

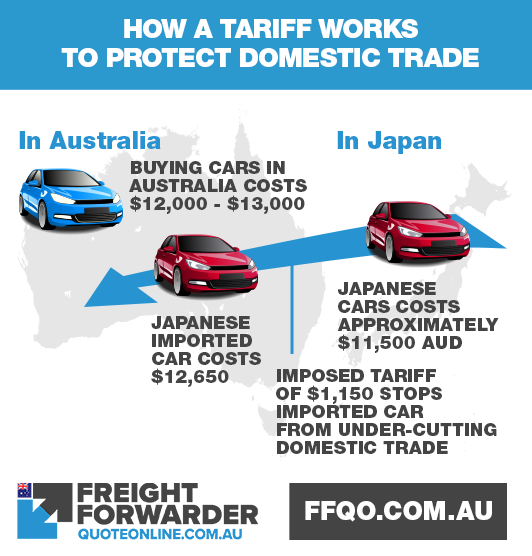

Also referred to as import duties, tariffs are calculated as a percentage of the value of a given imported product. This is imposed to promote domestic products vulnerable to foreign competition. It levels the playing field, as it also discourages imports by making these goods more expensive than items produced domestically.

Australia imports and tariffs explained

Import quotas on Australian products

The law of supply and demand means products not so readily available will become more expensive. In implementing import quotas, the prices of imported goods become higher relative to local produce. Other import restrictions, including currency restrictions and embargoes, can also be implemented. For this article, however, we shall focus solely on the various tariff rates and quotas implemented by Australia’s top three trading partners: China, Japan and the USA.

Beware of Australia import quotas

Beware of Australia import quotas

Australia’s top three trading partners

Other import restrictions, including currency restrictions and embargoes, can also be implemented. For this article, however, we shall focus solely on the various tariff rates and quotas implemented by Australia’s top three trading partners: China, Japan and the USA.

Australia imports from United states, China and Japan for 2019 to 2020

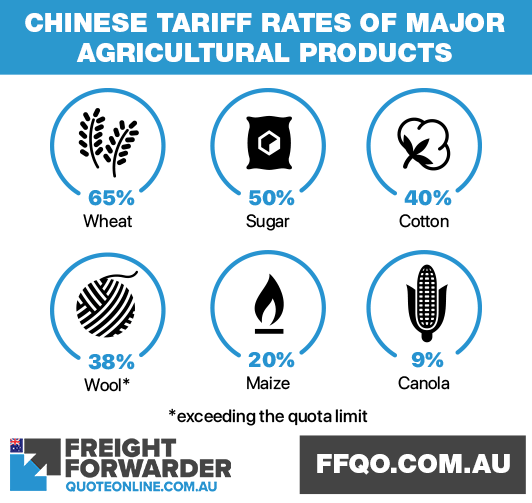

Imposed tariff rates and quotas of China on the following Australian imports

The China Australia Free Trade Agreement (CHAFTA) came into force on 20 December 2015, and is still current. This was agreed upon by the two countries after 10 years of negotiations. Tariff rates and quotas, however, still = remain the same for some of the commodities imported into China.

Australia imports on sugar – 50% tariff rate

Sugar is one of the major Australian imports into China. In the year 2015 alone, it imported US$314 million worth of products under this HS Code. This is 72.2% higher than 2014 imports which amounted to only US$183 million.

Amidst the ratification of ChAFTA, however, the tariff rates of sugar remains to be at 50%.

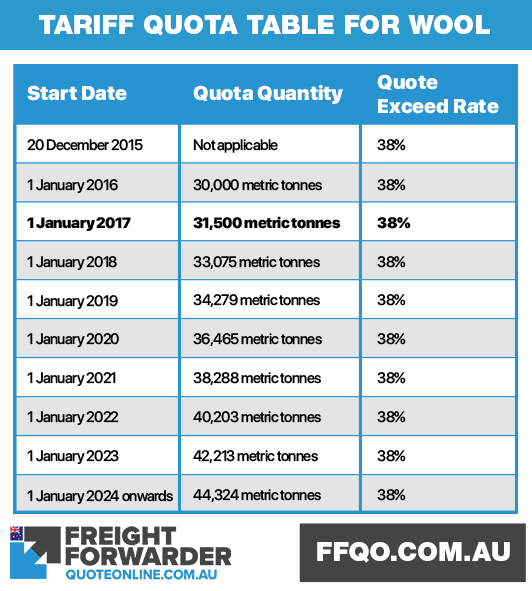

Australia imports on wool – 38% tariff rate exceeding the quota limit

Prior to the China-Australia Free Trade Agreement (ChAFTA) the tariff for this wool was at 38%. Beginning 1 January 2016 a duty-free annual tariff rate quota (TRQ) was implemented. This amounts to 30,000 metric tonnes – up to 44,324 on 1 January 2024. The table below shows this in detail.

Australia imports quota on wool via ChAFTA

Australia imports quota on wool via ChAFTA

Australia imports on cotton – 40% tariff rate

Another major item exported into China from Australia is cotton. In 2015 more than US$3 billion worth of products were imported from Australia. This is 48.6% less than 2014’s US$5 billion.

With ChAFTA still implementing the base rate tariff of 40%, it is unlikely that export of this item into China will be increasing.

Australia imports on wheat – 65% tariff rate

Another major item exported into China from Australia is cotton. In 2015 more than US$3 billion worth of products were imported from Australia. This is 48.6% less than 2014’s US$5 billion.

With ChAFTA still implementing the base rate tariff of 40%, it is unlikely that export of this item into China will be increasing.

Australia imports on maize – 20% tariff rate

Australian corn manufacturers suffer the same fate with ChAFTA, as tariff for their product remains at a base rate of 20%. This saw a decline of export from US$6 million in 2014 to just US$4 million for 2015.

Australia imports on canola – 9% tariff rate

Exporters of canola oil into China are also unhappy with ChAFTA as they see their export rate going down 16%, which was at US$773 million in 2014 but only $US649 in 2015.

Could this improve over time? Maybe, but with a tariff rate of 9% it’s unlikely to be the case.

Australia imports and Chinese tariff rates for major agricultural products

Australia imports and Chinese tariff rates for major agricultural products

Imposed Tariff Rates of Japan on Australian Imports

The Japan-Australia Economic Partnership Agreement (JAEPA) is set to deliver substantial benefits to the economy of Australia. Let us, however, take a look at how some of the tariff imports and quotas have changed due to the ratification of this agreement.

Rice, Barley and wheat

As of this moment, rice, barley and wheat continue to be governed under the Japanese Government’s Article 42 of “The Law for Stabilisation of Supply-Demand and Price of Staple Food”. This therefore continues to be subject to their discretion.

The law for stabilisation of supply-demand and price of staple food

Sugar

Sugar remains excluded from any tariff commitments, even under JAEPA. Please refer to this link for sugar products under HS CODE 1701.14.200 HS code 1701.14.200.

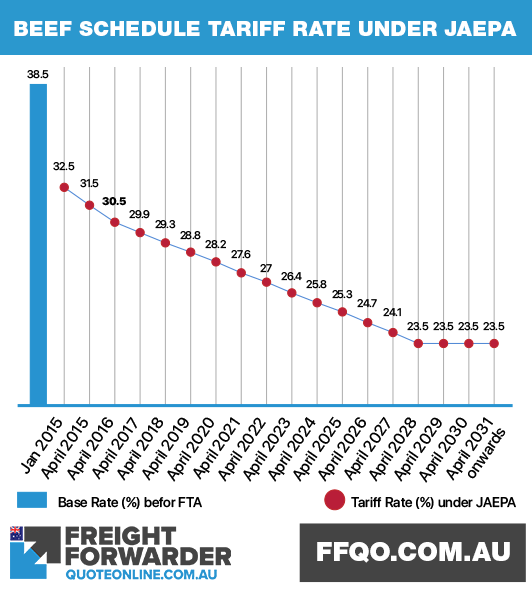

Beef scheduled tariff rate under JAEPA

The JAEPA gave a boost to the Australian beef industry, as it promised a gradual decrease of tariff rate. This reduced it from the base rate of 38.5% to just 23.5% on 1 April 2028. Please refer to the chart below for the complete schedule.

Further, it promises a cut of Japanese beef tariffs, either frozen (tariff rate drop to 19.5%), chilled or fresh (tariff rate drop to 23.5%) within 15 years. Given these tariff cuts, it is expected to boost Australian export by as much as $5.4 billion over 20 years.

Australia imports of beef scheduled tariff under JAEPA

Australia imports of beef scheduled tariff under JAEPA

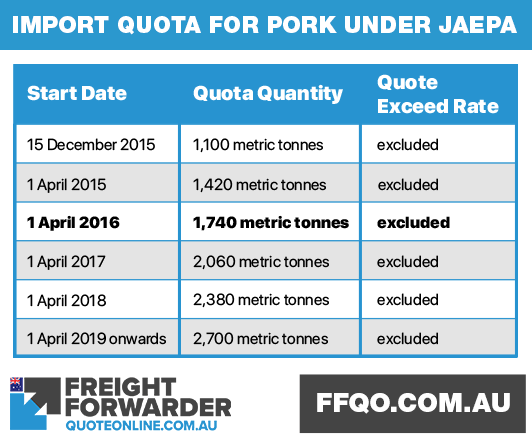

Pork – tariff rate reduced to 8% for above import quota

Exporters of pork to Japan, particularly sausages and similar products, of meat, meat offal or blood and food preparations based on these products, also rejoiced at news of a tariff rate reduction of 8% from the current base rate of 10% for port imports exceeding the quota rate.

The table below shows full details.

Australia imports of pork under JAEPA

Australia imports of pork under JAEPA

Imposed tariff rates of USA on goods from Australia

The Australia-US Free Trade Agreement (AUSFTA) is one of the earliest bilateral free trade agreements that came into effect on 1 January 2005. This allowed Australia to leverage the export of various goods into the USA. While, however, AUSFTA has been in effect for more than 20 years, there are still some goods that require tariffs and adhere to import quota requirements.

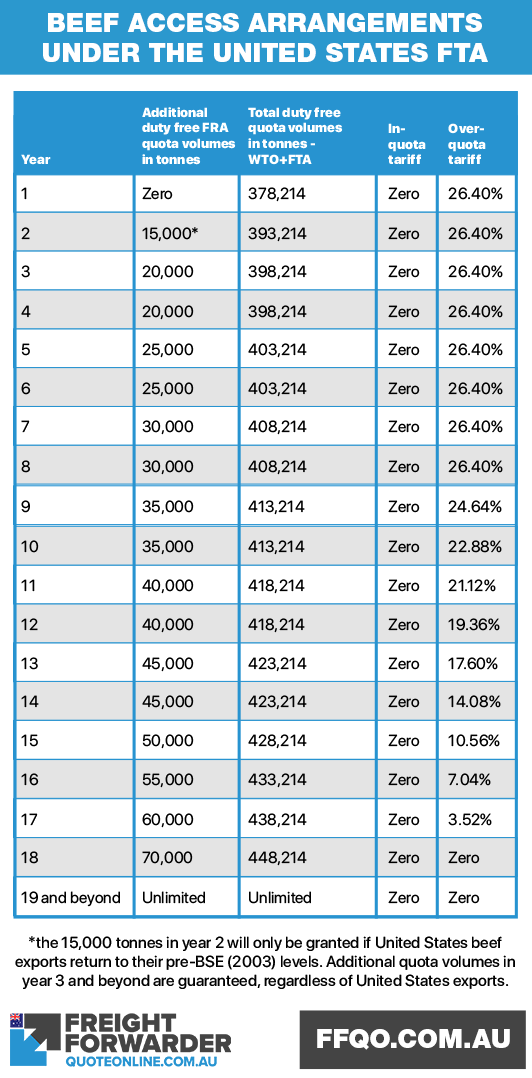

Beef Australia imports quota

Thanks to the AUSFTA, Australia was given an additional quota of 378,214 tons. It also allowed supplemental duty free access of 15,000 tons in its second year after the enactment and another 5,000 tons added annually or biannually.

Further, an additional quota at a reduced rate of 21% also allows 3,500 tons in the first year, rising to 7,000 tons in the year 2022. At this point the total duty free beef import quota access is at 418,214 tons, with a further 4,000 tons at reduced-duty.

By the year 2023 Australia will be enjoying unlimited duty free access to beef. The below table shows the details.

Australia imports beef arrangements via AUSFTA

Australia imports beef arrangements via AUSFTA

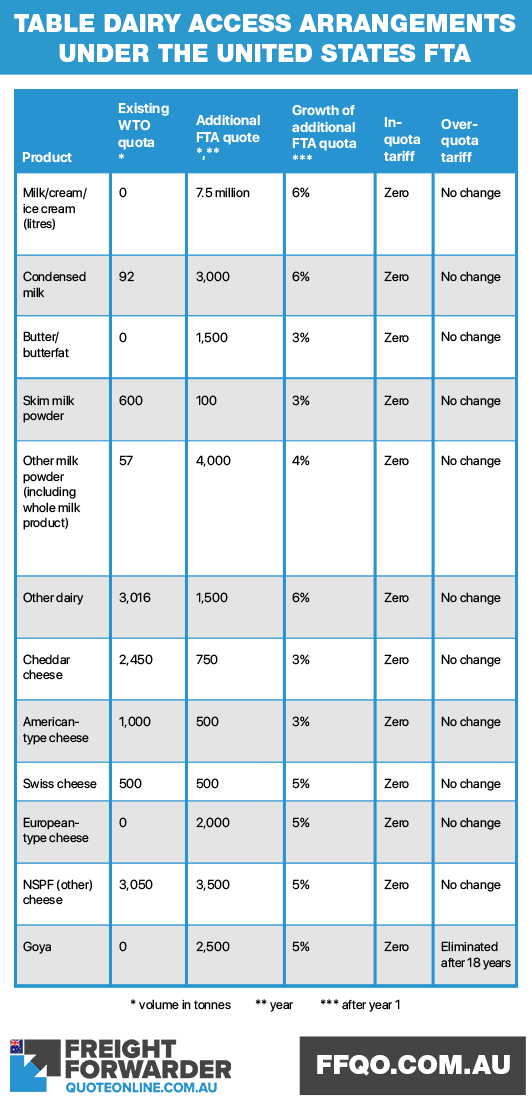

Dairy Australia imports quota

In the current AUSFTA there has been no change to the above-quota tariff on dairy products. Increased imports from Australia will amount to about 0.17% of the annual value of US dairy production and just 2% of the current value of total US dairy imports.

Australia imports dairy arrangements via AUSFTA

Australia imports dairy arrangements via AUSFTA

Sugar Australia imports quota

Similar to dairy products, the quota access for sugar remains unchanged. It is still at 87,402 metric tons based on the Uruguay Round Agreements between the two countries.

Tobacco and cotton import quota and tariff rates

Tobacco has a new import quota which starts at 250 tonnes in a year and grows by an additional three percent in subsequent years. Further, over-quota tariff rates are to be eliminated after 18 years, which means that these items can now freely enter Australia.

Peanuts import quota and tariff rates

As for peanuts and peanut products, these will be subject to the same tobacco and cotton tariff quota, but the volume difference is disparate. The quota volume for Year 1 was at 500 tonnes rather than the 250 tonnes implemented for tobacco and cotton.

Avocados tariff rates

There were two seasonal duty free tariff rate quotas for Australian avocados imported into the USA. During the second year of the AUSFTA, 1,500 tonnes may enter the US but between the 16 September and 31 January, 2,500 tonnes of Australian avocados may enter the US. In total 4,000 tonnes may enter the USA, and this will grow by an additional 10% each year. Since, however, the over-quota tariff is to be eliminated over a period of 18 years, avocados imported into the USA are already duty free.

These various tariff rates and quotas exist amidst existing bilateral agreements of Australia with China, USA and Japan. Exporting items into China, Japan and the USA is, however, really complex. You’ll need help from an expert brokerage team for your exported items so feel free to . contact us.

Check out our other recent articles

Latest news

Read up on the latest Australian freight forwarding news and developments:

Marine cargo insurance, should you buy it? - 28 May 2023

Aus UK FTA 2023 highlights in of the new free trade agreement - 07 Apr 2023

Types of cargo shipped via sea freight - 05 Mar 2023

Get social with us

Check us out on Facebook. Get social and like our page. Feel free to post your thoughts - we will appreciate it.

Come see our clips on our YouTube channel and subscribe so you are notified when we add new ones.

To keep up to date with the industry and read up on industry trends and developments, follow us on LinkedIn.

For quick updates, follow us on Twitter.

1300651233