Home » News »

How to avoid customs clearance delays when importing into Australia

« Previous | Next »

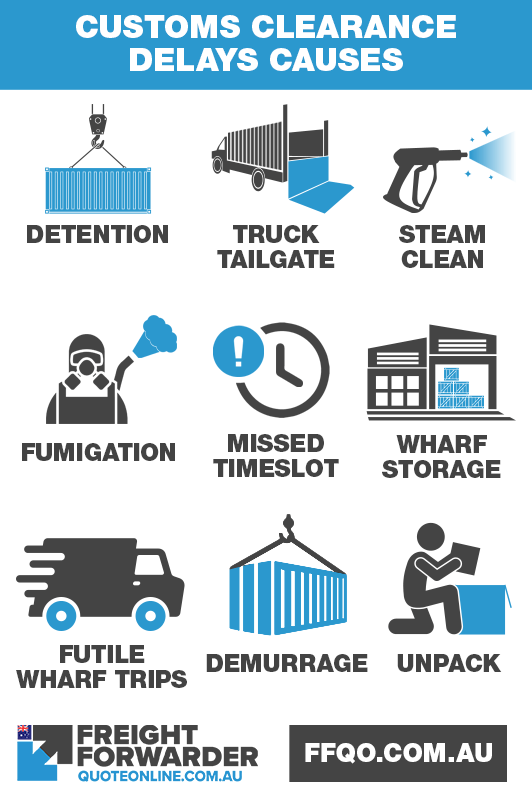

Customs clearance delays are costing importers a lot of money. As a rule they only have three days to clear their goods through customs and quarantine upon arrival. If it takes longer than this, various fees are added to the cost. These include wharf storage fees of between $100 and $250 per container per day.

How to avoid customs clearance delays when importing into Australia

What are the penalties and fees that result from customs clearance delays?

The other penalties and fees include the following:

FCL Detention (Full Container Load)

Detention rates apply if total delivery time – from pickup at wharf to unpacking at your premises and off-hire of empty containers – exceeds that allowed.

LCL Detention (Less than a Container Load)

Detention rates for LCL may also apply if waiting time at pickup or dropoff has exceeded the allocated time.

Via Depot

This is an additional cost if they cannot take delivery of the container and the available wharf time has lapsed.

Tailgate

This is a fee paid for cargo travelling to country areas, as ordered by the quarantine inspection officer.

Steam clean

This is required by the quarantine officer if dirt has been identified on your container.

Fumigation

This applies to wooden products or cargo that uses wood as packaging.

Missed time slot at the wharf

This may happen due to incorrect paperwork.

Futile trip to wharf

When the cargo misses its time slot a trucking company must be engaged. It sends a trick to the wharf to pick up the container delayed by customs.

Wharf or depot storage

This is another add-on cost. It is the result of insufficient paperwork to clear cargo before storage commences.

Container Demurrage

If the container is not returned to the shipping line within the allowed free time, additional fees will be incurred.

Unpack

Based on the discretion of the customs officer, your cargo may need to be unpacked.

How do you avoid this happening? Read on.

What are the penalties and fees that result from customs clearance delays?

What are the penalties and fees that result from customs clearance delays?

Have all the required documentation complete and ready

It is best to complete and submit the following documents to your customs broker at least five days prior to the estimated time of arrival (ETA). This will avoid your cargo being delayed by unwanted customs clearance.

Bill of Lading

This is issued to the shipper by your chosen freight forwarder at the port of export. It contains the precise contents of your shipment. This process will be simpler and more convenient for you if you work with a freight forwarding company that also delivers customs brokerage services

Your bill of lading may be issued as an Original Bill of Lading (OBL), Express Release or Telex Release. All of these are essential prior to your cargo being released at the port. It is, therefore, imperative that you have this document.

FFQO has both freight forwarding and customs brokerage services to assist you with your needs. Call us today.

Sample bill of lading

Sample bill of lading

Commercial invoice and packing list

This has a detailed list of what your shipment contains. It is best to have the original packing list as this is generally required by most customs brokers.

Packing list to avoid customs clearance delays

Packing list to avoid customs clearance delays

Packing declaration

This document contains the packaging used in moving your goods. Remember, wood packaging must be fumigated prior to being released at the port. It therefore becomes the basis of quarantine whether or not your cargo has to be fumigated.

If you are a frequent importer or exporter, Franklin can get an annual packing declaration from the shipper and have it approved by the quarantine department. Once approved, this will apply to all shipments from your supplier within a 12-month timeframe.

Packing declaration to avoid customs clearance delays

Packing declaration to avoid customs clearance delays

Additional documentation required

Other key documents you may need to prepare are the following:

- Certificate of Origin

- Commercial invoice

- Permits

- Packing lists

- Fumigation certificates

Other documents may include:

- Certificate of Analysis

- Manufacturer’s declarations

- Lot codes and batch numbers

- Costings and assist sheets

- Phytosanitary certificate

Do you have questions with the above mentioned documents? Send us a message and we will assist.

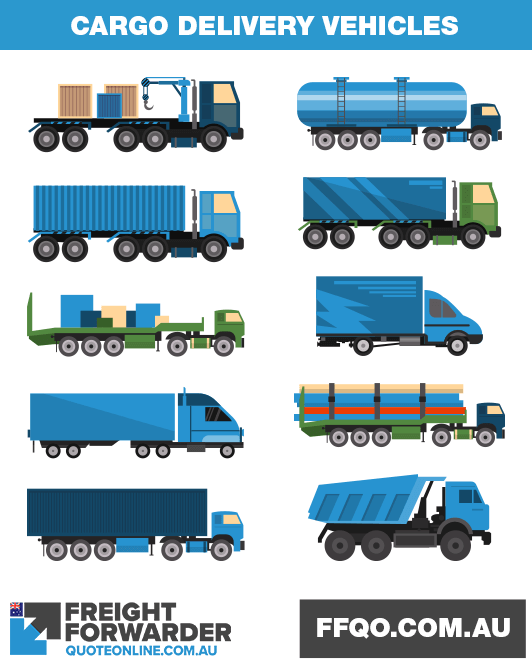

Preparing the cargo delivery after customs clearance

After your cargo has been cleared it must be delivered from the wharf, air bond store or LCL unpacking depot. To avoid problems with your choice of vehicle, you need to choose the right delivery vehicle.

Standard Truck and Trailer

This is best suited for conventional deliveries. It delivers your cargo to your loading dock while unloading the goods directly from the container into your chosen warehouse.

Truck with a rigid tray

This is the best option for tray truck delivery options. It is used when there is a restricted space and a normal articulated truck and trailer will not fit. It is short length allowing it to access premises where there is a shortage of space.

Standard truck and trailer

This is perfect for drop trailer shipments. The container is driven to your premises and left on the trailer for unloading.

Truck with trailer equipped with lifting arms

This is the vehicle of choice for side loader deliveries. Using this, the container is delivered to the premises and lowered to the ground by the trailer’s lifting arms.

Types of vehicles used to transport cargo from port to door

Types of vehicles used to transport cargo from port to door

Additional tips to avoid customs clearance delays

As much as you wish to do it on your own, there are many rules, regulations, forms and terms that will be unfamiliar to you. You need, therefore, to follow these additional tips and advice.

Ask the help of expert customs brokers

Engage expert customs clearance brokers who can help you properly file your goods. These trained professionals have many years of experience. They have mastered and work with Free Trade Agreements, Concessions, duties, taxes and GST, serving importers and exporters.

Let your customs broker and freight forwarder collaborate with one another

Enquire whether your freight forwarder is allowing your customs broker access to their records. They need this to ‘copy’ the paperwork and have it pre-checked for errors. This is particularly important for goods requiring special quarantine requirements and clearances.

If this is not possible, ask in advance if the commercial and regulatory documents mentioned earlier can be forwarded to you, the importer, at least five days prior to the vessel berthing at the first Australian port.

Freight forwarder and broker collaboration to avoid customs clearance delays

Freight forwarder and broker collaboration to avoid customs clearance delays

Consider effects of holidays

Holidays such as Christmas, Chinese New Year and Easter are a few of the periods when excessive demand impacts the entire supply chain. These seasonal peaks can cause severe delays, as it can be very difficult to book your cargo.

Avoid these problems by making arrangements ahead of time with your chosen freight forwarder and customs broker. Not doing this risks your goods not arriving until after the holiday season.

Customs clearance delays and the holiday rush

Customs clearance delays and the holiday rush

Need help to avoid customs clearance delays when importing into Australia

Do you have additional questions about how to avoid customs clearance delays? We’re happy to help you with it. Send us an online message or contact us via our Facebook page so you can avoid customs clearance delays when importing into Australia.

Check out our other recent articles

Latest news

Read up on the latest Australian freight forwarding news and developments:

Marine cargo insurance, should you buy it? - 28 May 2023

Aus UK FTA 2023 highlights in of the new free trade agreement - 07 Apr 2023

Types of cargo shipped via sea freight - 05 Mar 2023

Get social with us

Check us out on Facebook. Get social and like our page. Feel free to post your thoughts - we will appreciate it.

Come see our clips on our YouTube channel and subscribe so you are notified when we add new ones.

To keep up to date with the industry and read up on industry trends and developments, follow us on LinkedIn.

For quick updates, follow us on Twitter.

1300651233