Home » News »

Top seven causes of customs penalties for importers

« Previous | Next »

Customs penalties for importers mean additional costs and delay of cargo delivery. This is bad news for small to medium-sized enterprises, that generally have limited resources to support their business.

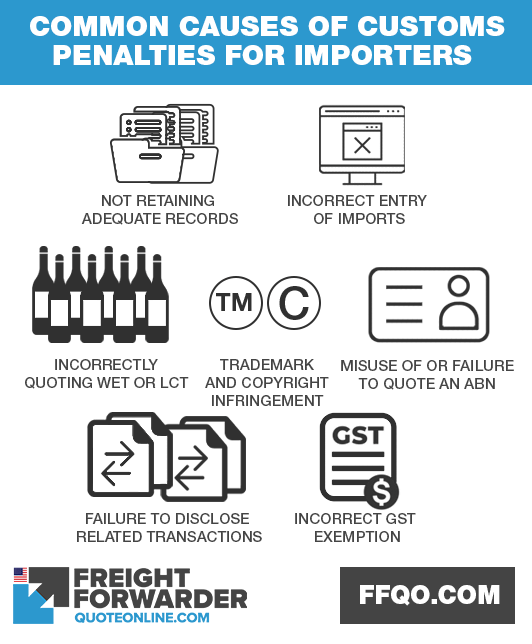

Top seven causes of customs penalties for importers

Today, we show you how to avoid these customs penalties for importers. Read on and learn the top seven reasons importers get penalised by Customs and how these can be prevented.

Failure to retain adequate records

Customs requires retention of all relevant commercial documents for five years from the date of entry. This includes documents that relate directly to the shipment, such as:

- Bill of lading

- Commercial invoices

- Packing lists

Customs, however, also requires you to keep all documents relating to the importation of the goods. These documents include:

-

- Price quotes

- Inventory receipts

- Financial statements

- Copies of the Customs entry

If you adhere to this rule and provide these to your Customs broker, this will ensure they enter accurate entries of your imported goods. This is a typical Customs penalty for importers, and easy to avoid.

Incorrect entry of imports

It is easy to make mistakes and incorrectly submit imports, as it is a challenge to:

- Correctly enter goods

- Properly classify items

- Accurately report shipments (to include any surplus goods)

Correct entry is time-consuming and requires extensive knowledge of Customs rules and regulations. The most efficient and accurate is to have an expert Customs broker do this for you. Hiring an in-house Customs broker, however, to perform these tasks may not be a cost-effective solution for start-up and growing businesses.

Non-disclosure of related transactions

A personal or corporate relationship, resulting in commissions or royalties on the original price, may pose a problem for importers if undisclosed. It is essential to remain transparent with all your transactions to ensure your goods are cleared without delay and penalty.

Poor understanding of valuation method common cause of Customs penalties

Customs commonly use the transaction value method in determining the Customs value of imported goods. This method uses the actual price paid for the items. There are, however, instances where personal or corporate relationships influence the price of import. In such instances, the transaction value method cannot be used. One of these alternative valuation methods must be chosen:

- Identical-goods value

- Similar-goods value

- Deductive-value

- Computed-value

- Fall back-value

Incorrect GST exemption

Australian Customs and Border Protection Service (ACBPS) is the government body responsible for collecting and calculating GST on imported goods. They ensure that:

- GST exemptions claimed by importers are correct

- Value of the taxable importation is correctly calculated

- GST payable on taxable importations is paid to the ACBPS or appropriately deferred for payment on the next Business Activity Statement

How to be sure you declare the right GST exemption to avoid Customs penalties?

Hiring an expert Customs broker to help you is the most convenient and surest way to ensure you’ll be declaring the right GST exemption. You should, however, check the background and years of experience of the Customs clearance firm to guarantee you are dealing with expert, reliable and professional Customs brokers.

Incorrect WET or LCT quote

Industries dealing with alcoholic beverages and luxury cars have the option to quote for Wine Equalisation Tax (WET) and Luxury Car Tax (LCT) if, and only if, they have an Australian Business Number (ABN). This, however, requires full understanding of the complex calculation process that goes with WET and LCT.

Unsure on how to validly quote for WET or LCT? Call us at 1300651233, today.

Misuse of or failure to quote an ABN

ABN is one of the most important pieces of information any importer should have.

The The Australian Taxation Office (ATO) (ATO) defines it as, “a single identifier that non-profit organisations use to: register for GST and claim GST credits, register for PAYG withholding, deal with investment bodies, apply to us for endorsement as a deductible gift recipient or tax concession charity, interact with other government departments, agencies and authorities, interact with us on other taxes, such as FBT.”

This has to be supplied to Customs when formally entering goods for GST purposes in order to claim input tax credits or access the GST-deferral scheme. Failure to do so and misuse may result in unwanted penalties.

Avoid this happening. Find someone who ensures all your business information is accurately entered. Complete our online form and send us your query.

Trademark and copyright infringements

Importing and selling goods that infringe trademarks or copyright is outright illegal and can result in prosecution. Those who import pirated or counterfeit items are importing flawed products and supporting an illegal industry. They are involving themselves with people who deal with serious criminal activity and are capable of causing much harm. All importers should help stop trademark counterfeiting and copyright piracy by not bringing these goods into Australia. Generally, the Australian Border Force (ABF) will seize and destroy imported counterfeit and pirated goods.

Common causes of customs penalties for importers

Customs penalties for importers are easy to avoid with an expert like us

Avoid Custom penalties; find someone who ensures all your business information is accurately entered. When you have a small number of resources to support your business’ shipping process you don’t want added Custom clearance costs or overheads.

Reduce risk of Customs penalties by outsourcing custom clearance?

We make Customs clearance fast and simple. In this way we ensure you never have to pay additional duties and penalty payments due to incorrect lodgement of entries. By choosing an expert Customs broker, you get the support you need. We can easily address complex issues, such as matching your records against transaction records, ensuring strict non-disclosure of goods and preventing added charges like royalty fees. They will also settle tax and duty amounts accurately using known GST exemptions.

Find out other ways a Customs broker will help you avoid penalties and save you time and money. Feel free to contact us online or message via our Facebook page and let us help your business avoid Customs penalties.

Check out our other recent articles

Latest news

Read up on the latest Australian freight forwarding news and developments:

Marine cargo insurance, should you buy it? - 28 May 2023

Aus UK FTA 2023 highlights in of the new free trade agreement - 07 Apr 2023

Types of cargo shipped via sea freight - 05 Mar 2023

Get social with us

Check us out on Facebook. Get social and like our page. Feel free to post your thoughts - we will appreciate it.

Come see our clips on our YouTube channel and subscribe so you are notified when we add new ones.

To keep up to date with the industry and read up on industry trends and developments, follow us on LinkedIn.

For quick updates, follow us on Twitter.

1300651233